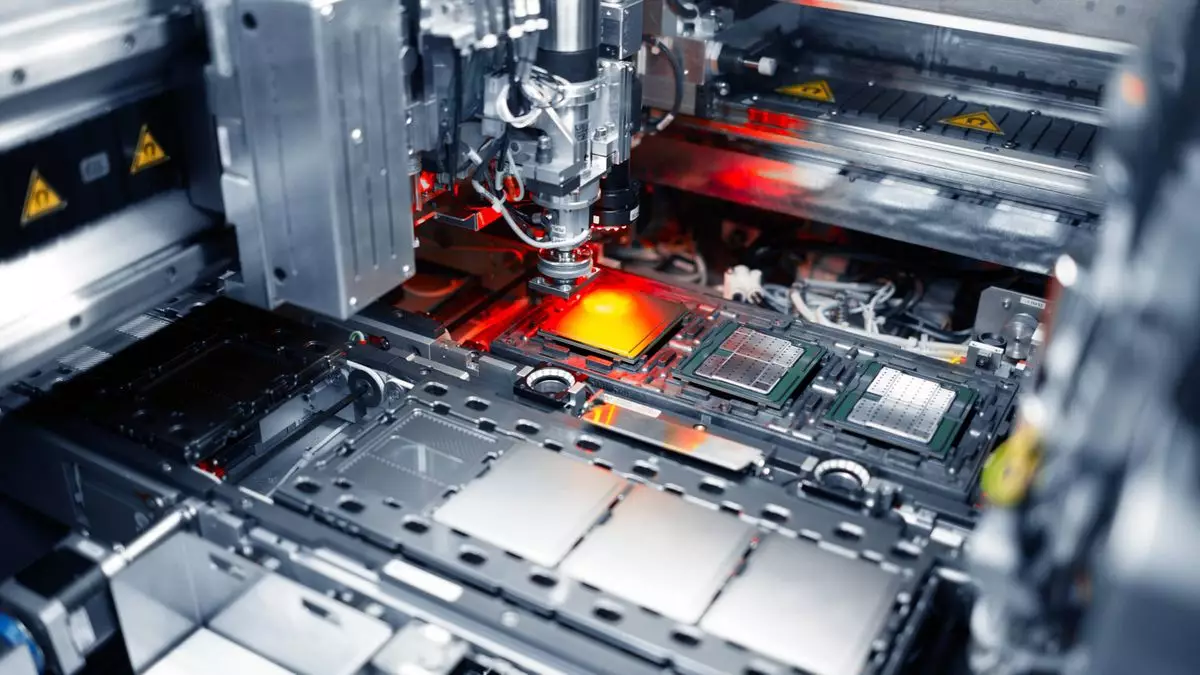

The semiconductor industry is renowned for its volatility and intensity, but recent rumblings regarding Taiwan Semiconductor Manufacturing Company (TSMC) and Intel Corporation suggest an inflection point that could reshape the landscape significantly. TSMC, the dominant player in outsourced chip manufacturing, appears to be courting Nvidia, AMD, and Broadcom for a joint venture aimed at revitalizing Intel’s beleaguered fabrication plants. This potential alliance raises more questions than answers, notably about Intel’s future viability and its competitive stance in a rapidly evolving market.

Until recently, discussions hinted at a partnership between TSMC and Intel that would see Intel’s factories run under TSMC management. However, these rumors fluctuated between speculation and skepticism. This inconsistency underscores the uncertainty surrounding Intel, especially considering its staggering financial fallout—a projected loss of $18.8 billion for 2024. The abrupt dismissal of CEO Pat Gelsinger, once heralded as the company’s savior, adds fuel to the fire of speculation about Intel’s capabilities to right the ship.

Ownership Stakes and Political Overtones

What complicates this story further is the assertion that the ownership structure of such a venture would prevent TSMC from claiming a controlling interest. Reports indicate that TSMC’s stake would be capped at 50%, potentially appeasing U.S. regulatory frameworks concerned about foreign control of a critical domestic technology company. Moreover, there are whispers suggesting that the Trump administration itself might be indirectly orchestrating these developments to save what is perceived as a national asset. This intersection of corporate ambition and political maneuvering highlights how intertwined these realms have become in today’s global economy.

The fact that TSMC might step into this role aligns with its reputation for operational excellence and cutting-edge technology. However, the credibility of such a partnership hinges on how quickly Intel can deliver its much-anticipated 18A process node, which promises to compete with TSMC’s renowned N3 and upcoming N2 technologies. The chips produced under this new technology could potentially outline Intel’s path forward. If successful, the company may consolidate its fabs; if not, divestiture might be its only path toward a sustainable future.

Corporate Resistance and Internal Conflicts

Industry insiders reveal a complex web of internal politics within Intel as discussions regarding the potential joint venture unfold. Sources claim that while some board members are in favor of collaborating with TSMC, others are staunchly opposed, showcasing the divide in vision and strategy among Intel’s leadership. This discord highlights the broader implications for the company’s corporate governance and strategic alignment.

Moreover, the demand for alignment among executives raises essential questions about trust and risk management in an industry characterized by rapid changes and the need for agility. The opinions of leadership can often dictate a company’s trajectory, and in a situation where the stakes are as high as they are for Intel, cohesive decision-making is critical.

Looking Ahead: A Market on the Brink

As we navigate through this uncertain terrain, the overarching sentiment remains one of suspense. TSMC’s overtures to Nvidia, AMD, and Broadcom indicate that the semiconductor industry is actively exploring strategic collaborations that could redefine competitive dynamics. If Intel can successfully roll out the 18A technology and establish itself firmly in the market, it may regain lost ground yet; failure could lead to further disarray and potential divestiture.

Ultimately, the semiconductor market is still evolving, with Intel teetering precariously at the edge. While the narrative may seem like a soap opera filled with ups and downs, it reflects a broader reality—the relentless pursuit of innovation, the battle for technological supremacy, and the intricate dance between corporate aspirations and external influences. As we witness these developments unfold, one thing is clear: the stakes have never been higher for Intel and its allies, and the outcome will likely ripple across the entire tech ecosystem.