In an era where technology permeates every aspect of our daily lives, the rise of artificial intelligence (AI) seems poised to revolutionize personal finance. Many companies in this sector are marketing AI as the future solution to our financial woes—an intelligent assistant armed with our data that can guide us towards financial independence. But while the concept is attractive, an in-depth exploration reveals a contrasting reality: AI financial advisers may not be the saviors we hoped for, and their influence could lead individuals deeper into financial entrapment rather than providing the genuine support they claim to offer.

AI financial platforms like Cleo and Bright have gained traction, particularly among younger users who seek affordable solutions outside conventional human financial advisors. These chatbots promise personalized advice, utilizing algorithms that analyze past transactions and spending habits. The appeal lies in the convenience: users can receive tailored suggestions for budgeting and debt repayment almost instantaneously, all while bypassing the hefty fees associated with traditional financial planning.

The underlying promise is compelling—imagine having a financial coach available 24/7, ready to suggest strategies designed specifically for you. As AI representatives reflect on your financial past, they stand ready to guide you on a path toward financial health. However, the romanticized image of AI as a neutral coach may overlook some inherent discrepancies.

To use these platforms, users are often required to connect their banking accounts through third-party services such as Plaid, which raises significant concerns about privacy and security. By tying their finances to an app, users hand over data that can be used to market additional services back to them, effectively turning their financial needs into revenue streams for these companies. For instance, Cleo’s marketing approach appeared more akin to a salesperson than a financial confidant, subtly encouraging users to pursue cash advances, thereby potentially leading them into a cycle of debt.

Upon engaging with Cleo, I experienced a momentary sense of understanding—an automated conversation mimicking empathy regarding my concerns about insufficient funds before it quickly pivoted to offering cash advances. Despite claiming to assist users struggling to manage their finances, this approach risks entangling them in a trap of temporary financial relief that ultimately necessitates additional repayment, consequentially fostering a reliance on credit rather than promoting fiscal responsibility.

Similar sentiments arose during my exploration of Bright, another AI tool designed to tackle debt management. Unlike Cleo, which offered short-term cash solutions, Bright presented users the opportunity to pursue larger debts—potentially amplifying existing financial challenges rather than alleviating them. A stark contrast emerged as well—where Cleo evoked engagement through humor and relatability, Bright’s chatbot faced issues with inaccuracies, erroneously claiming significant losses in insufficient funds fees. This inconsistency raises doubts about the reliability of AI-driven financial guidance.

While Bright targets users in dire financial straits, its high subscription fees and promises of access to substantial cash from third-party lenders evoke questions surrounding the ethics of pursuing quick-fix solutions for users already confronting financial instability.

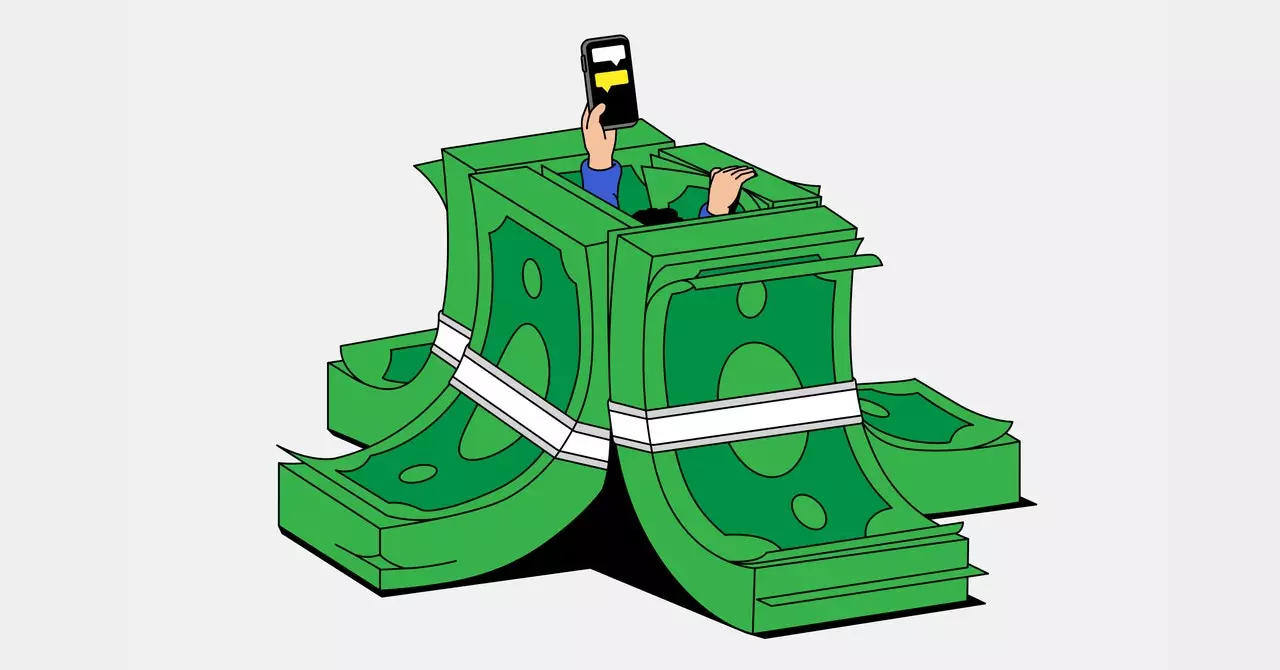

In an ideal scenario, AI-driven financial advisers would function as trusted allies providing sound financial strategies. However, the current trajectory suggests that these platforms increasingly prioritize profit through upselling and drive users towards deeper financial commitments. In a world where user-friendly interfaces and instantaneous responses mask the gravity of financial decision-making, individuals risk surrendering autonomy to algorithms that may not fully appreciate the nuances of their personal circumstances.

Youthfully optimistic and often financial illiterate users may find themselves ensnared in a precarious cycle of debt management, promoted not by the intent of fostering comprehensive financial health but rather by the underlying aim of keeping them engaged—or dependent—on continuously marketed financial solutions.

As AI financial advisers continue to evolve, users must approach these tools with a discerning eye. While the promise of personalized, tech-driven financial guidance is compelling, one must remain vigilant against the potential pitfalls that accompany reliance on such technology. Ultimately, the future of AI in personal finance should not just serve to enhance user experience but strive to empower individuals with the knowledge and tools necessary for sustainable financial well-being. Balancing convenience with responsibility may very well dictate the effectiveness—and ethical implications—of AI in managing our financial futures.