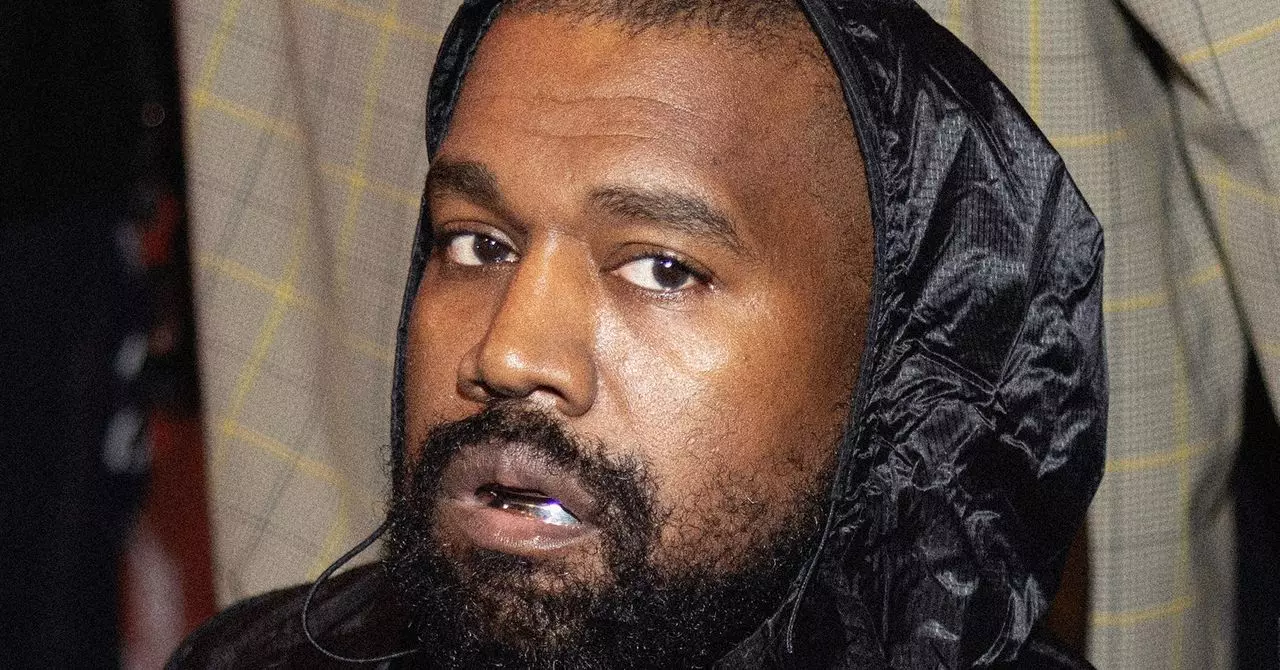

In recent years, the intersection of celebrity influence and the volatile world of cryptocurrency has produced a series of high-profile experiments—and spectacular failures. Kanye West, aka Ye, has historically embodied this phenomenon, often pushing boundaries in music, fashion, and public discourse. His latest venture, the YZY coin, exemplifies not just the risks but also the dangerous allure of celebrity-backed digital assets. What begins as a spectacle often transforms into cautionary tales—yet they continue to captivate investors and observers alike.

At first glance, West’s sudden pivot from firm denial (“I’m not doing a coin”) to an aggressive launch within months underscores a broader trend: celebrity culture driving rapid financial speculation. His YZY coin, embedded within a larger ecosystem branded YZY Money, promises empowerment through decentralization—a hip yet seemingly hollow narrative that glosses over the murky realities of crypto markets. When figures of West’s stature endorse or create their own coins, it’s not merely about new revenue streams; it’s about leveraging fame to tap into the biggest, most emotionally charged investment pools.

However, the fallout from the YZY coin launch underscores just how perilous this practice can be. The coin’s paper valuation soared to a staggering $3 billion before collapsing by over 66% within hours—an execution that reveals both the thrill and the fragility of hype-driven bubbles. Investors, many new to the market, saw over $740 million poured into trading activity, only to collectively lose more than $20 million. Such dynamics exemplify how celebrity-backed coins often operate on the razor’s edge between innovation and exploitation, with the latter more common than many admit.

The Illusion of Control and Risks of Centralized Holdings

One of the most striking aspects of the YZY coin is its seemingly decentralized narrative, promising users freedom from traditional authorities. Yet, the facts tell a different story. A substantial portion of the coin’s supply is controlled by Yeezy Investments LLC—70%, with a three-month lock-up period meant to prevent sudden dumps. Still, control over a majority stake raises fundamental questions about the true decentralization touted by YZY Money.

This concentration of supply is a typical red flag for seasoned crypto traders. When a small group holds significant control over a coin, volatility and manipulation become inherent risks. If, after the lock-up period, insiders decide to liquidate their holdings en masse, the price could crater, leaving unsuspecting investors stranded. In the case of YZY, accusations of potential market manipulation intensify due to the initial surge and rapid decline, pointing to the classic pump-and-dump cycle often associated with low-regulation tokens.

Furthermore, West’s management structure—through a Delaware-registered entity with undisclosed ownership—adds layers of opacity. This lack of transparency is typical in amateurish or speculative crypto projects but particularly concerning given West’s reputation for unpredictability and controversial statements. The risk isn’t just financial but also ethical, as investors may be caught in the crossfire of a project that appears more about chasing hype than delivering value.

The Cultural and Psychological Impact of Celebrity Crypto Projects

West’s descent into erratic public behavior, including antisemitic remarks and provocative music videos, underscores the complex psychology driving his recent ventures. His influence remains undeniable, but it’s increasingly intertwined with controversy and unpredictability. The launch of YZY Coin isn’t just a financial experiment; it’s an extension of a persona that thrives on shock value, disrupting norms and challenging authority.

From an investor perspective, this raises questions about the long-term viability of celebrity-led projects. When the figure behind a coin is known for erratic behavior or controversial statements, the stability and credibility of the project come into question. Does West genuinely see YZY as a pathway to innovation, or is it merely an extension of his brand’s chaotic evolution? The answer influences whether this project is a fleeting trend or a harbinger of a new paradigm—one where celebrity influence can create genuine, lasting change in the crypto space, or simply volatile spectacles that are here today, gone tomorrow.

The cultural impact extends beyond financial markets. Celebrity cryptocurrencies often serve as barometers of trust—or mistrust—in the broader digital economy. They reveal our collective fascination with instant riches and the allure of fame, often disregarding fundamental principles like transparency, utility, and accountability. West’s YZY coin, with all its hype and chaos, exemplifies the dangerous cocktail of celebrity influence and speculative greed that continues to destabilize the nascent crypto industry.