Spotify’s latest move to broaden its audiobook offerings marks a pivotal shift in how digital streaming platforms embrace integrated media consumption. Historically, Spotify’s strength lay in music and podcasts, but the inclusion of audiobooks signals a strategic attempt to diversify its content portfolio. The recent introduction of the Audiobooks+ plan in the U.S. epitomizes this evolution, not merely as a product extension but as a bold effort to redefine household media boundaries. By enabling multiple household members on Family and Duo plans to access audiobooks seamlessly, Spotify is challenging traditional content access limitations that have long plagued audiobook services. This democratization of access positions Spotify as a more inclusive platform, capable of catering not only to individual listeners but also fostering shared experiences within households.

This shift is more than a technical tweak; it is a reflection of changing consumer behavior. Consumers increasingly consume media collectively, and Spotify appears to recognize the value in fostering communal listening experiences. Offering 15 hours of additional audiobooks each month as part of the subscription highlights a desire to keep users engaged longer, maximizing the value they derive from their plans, while simultaneously increasing potential revenue streams for the platform.

Strategic Rationale Behind the Pricing and Features

Spotify’s decision to set the Audiobooks+ plan at $11.99 per month reveals careful strategic planning. The price is positioned just above the standard Premium plan, signaling a premium offering tailored for fervent audiobook enthusiasts. The option to add recurring hours demonstrates an ambition to attract heavy listeners who might otherwise turn to specialized audiobook platforms. While for casual listeners this may seem excessive, it underscores Spotify’s intent to appeal to a niche of dedicated users who consume large volumes of spoken-word content.

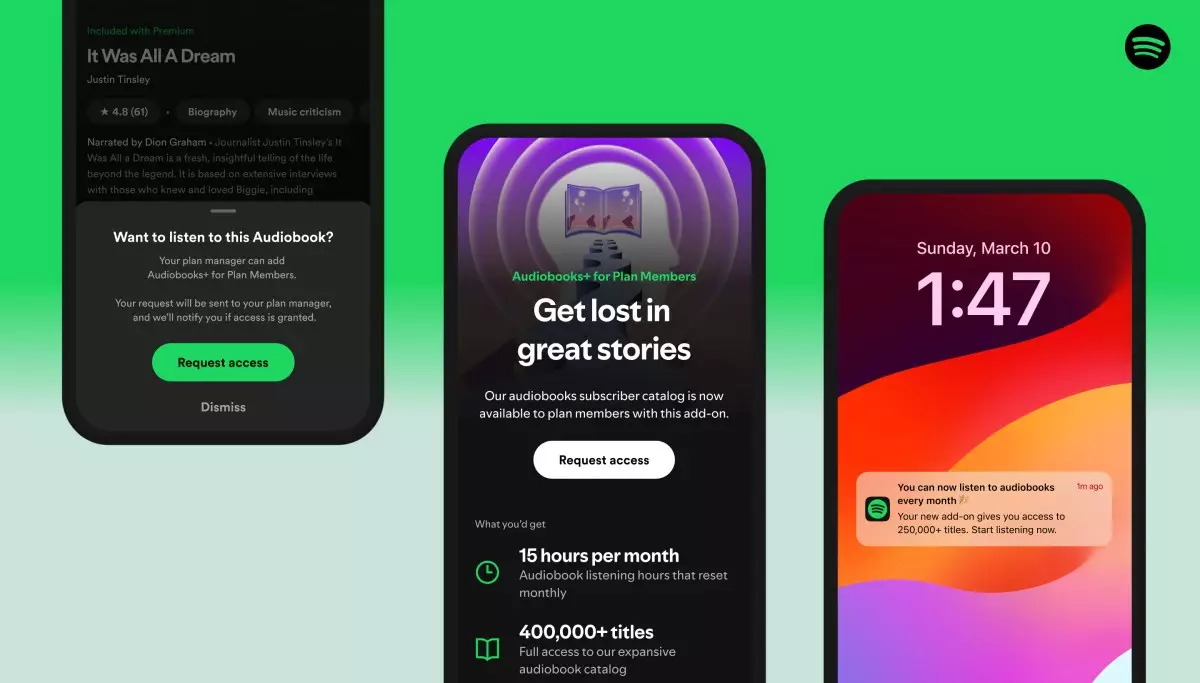

Moreover, the expansion to include household members on non-cardholder accounts suggests an understanding of the shifting dynamics of family media consumption. In the past, technical and policy barriers limited family sharing of audiobooks, but Spotify’s approach appears to address these pain points by offering targeted solutions through the “Audiobooks+ for Plan Members” plan. This not only increases accessibility but positions Spotify as a more user-friendly and flexible platform, capable of accommodating the diverse needs of modern families.

The broader industry implications are also noteworthy. As Spotify experiments with tiered offerings and expands its content realm, it attempts to establish a competitive advantage over dedicated audiobook services like Audible. By integrating audiobooks into its existing ecosystem, Spotify leverages its vast user base—over 696 million active users and 276 million paid subscribers—to boost engagement and monetization. The strategic alignment underscores a deliberate move to turn audiobook listening from a niche activity into a mainstream behavior.

Market Dynamics and Future Implications

Spotify’s expansion arrives at a complex moment for the company. While the streaming giant faces setbacks, including missed earnings and a sluggish advertising business, its user growth continues unabated. Active users and paying subscribers are on an upward trajectory, which offers a fertile ground for cross-selling new services like Audiobooks+. This tactic underscores a broader corporate philosophy: cultivating a comprehensive ecosystem of audio content that locks users into a seamless, all-encompassing experience.

The company’s acknowledgment of the growing popularity of audiobooks—up over 35% year-over-year in key markets even before the new plans—illustrates a keen awareness of industry trends. By investing in features that improve household access and offering flexible subscription options, Spotify aims to cement its position as the go-to platform for all auditory content. Future experiments, including direct sales options, hint at a desire to further diversify revenue streams and deepen user engagement.

Spotify’s strategic push into audiobook territory exemplifies a broader vision: creating a versatile, family-friendly, all-in-one audio hub. Their targeting of household sharing barriers and premium subscription options signals intent not only to compete but to redefine the way we consume spoken-word content within our daily and family routines. This aggressive expansion, set against a backdrop of corporate challenges, highlights Spotify’s resilience and adaptability in a rapidly evolving digital audio landscape.