Lumotive, a pioneering startup in programmable optics, has recently attracted significant new investment, reinforcing its position in the burgeoning field of light manipulation technology. The company’s decision to reopen its Series B funding round to include major players like Amazon and Oman’s ITHCA Group underscores a growing industry belief in its innovative capabilities. With Amazon’s participation, the strategic value transcends mere capital; it opens pathways to integration within vast global logistics and data ecosystems. Similarly, ITHCA’s involvement indicates interest from sovereign wealth funds seeking future-proof tech avenues. Earning a total of $59 million in this round alone, Lumotive has surpassed the initial milestone, now boasting over $100 million accumulated in venture capital. Such backing is not just financial; it signifies validation of Lumotive’s technological prowess and market potential, positioning it as a formidable contender in optical and sensing solutions.

From Cutting-Edge Tech to Market Reality

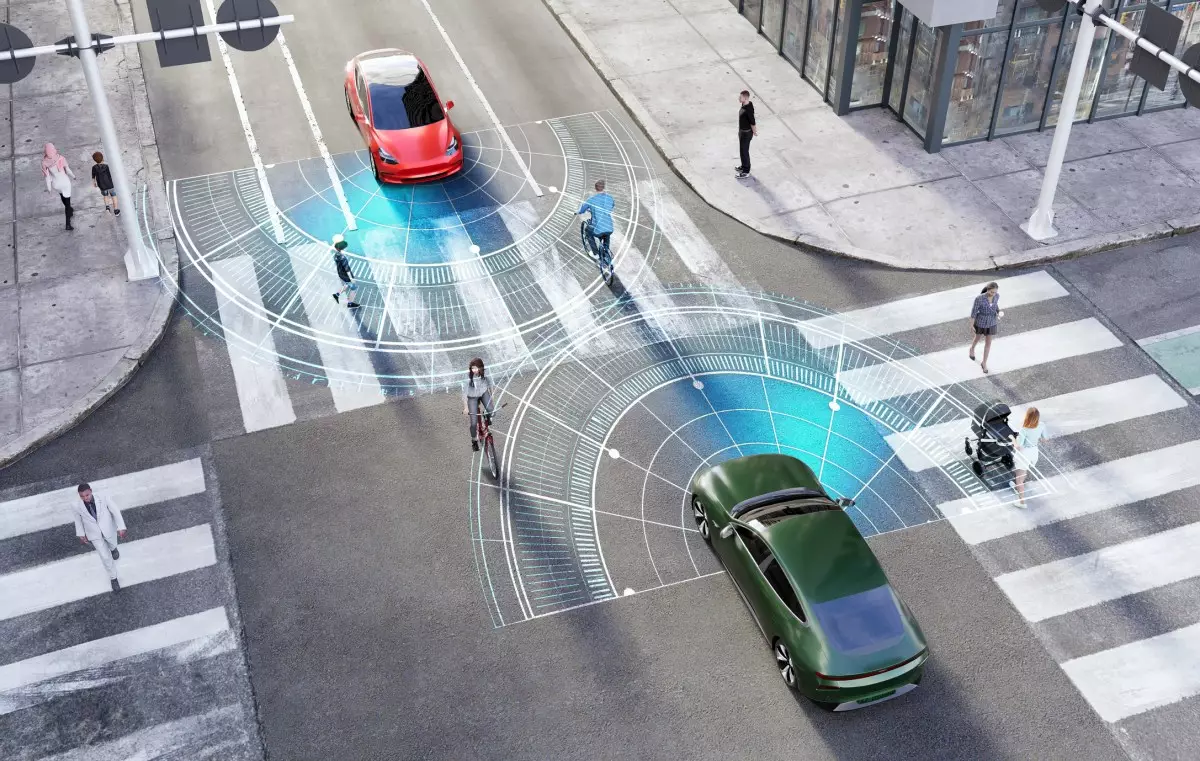

Lumotive’s core innovation lies in its Light Control Metasurface chips—an impressive feat of nano-scale engineering that electronically manipulates light. Unlike traditional optics relying on bulky mirrors and mechanical motors, these chips achieve dynamic light shaping through electronically controlled pixels. This breakthrough allows for versatile applications, from intricate sensing systems in autonomous vehicles to hyper-compact LiDAR alternatives. The capability to electronically focus, steer, and shape light represents a paradigm shift in optical technology, transforming how devices sense, communicate, and process information. Lumotive’s CEO, Sam Heidari, emphasizes that such advanced control over light is akin to replacing mechanical parts with electronic precision—an evolutionary leap that promises more compact, cost-effective, and reliable solutions.

Market Adoption and Future Growth Trajectory

Having moved from conceptual innovation to tangible product offerings in 2024, Lumotive’s approach has been intentionally selective regarding its customer base. This strategic focus ensures quality and reliability while establishing a strong foothold in niche markets. However, the company’s recent fundraising indicates plans for aggressive expansion. Heidari’s remarks about channeling funds into sales, marketing, and R&D reveal a clear roadmap: cementing existing technological advantages and broadening market reach. For a technology no longer in the experimental stage but established as field-ready, the potential for widespread adoption is considerable. As industries increasingly demand sophisticated, miniaturized, and electronically controllable optical systems, Lumotive’s solutions are poised to capitalize fully on these trends, hinting at a future where smart light management becomes integral to everyday tech.

Critical Reflection: A Double-Edged Sword of Innovation

While Lumotive’s visionary approach undoubtedly pushes the boundaries of optical science, it also invites scrutiny. Relying heavily on strategic partnerships with tech giants like Amazon carries inherent risks—partnerships can foster dependency and shift priorities. Moreover, the heavy investment into R&D, though essential, might overshadow the challenges of scaling production and winning broader market acceptance amid competitive pressures. There’s an underlying tension between revolutionary potential and practical implementation hurdles. The company’s emphasis on “not being a science project anymore” signals confidence, but such bold claims demand cautious optimism. Success hinges on execution—turning the promise of electronically manipulated light into reliable, market-ready products that can withstand real-world conditions and customer demands.

By critically assessing Lumotive’s trajectory, one must appreciate both its technological ingenuity and the hurdles it faces. The pursuit of smarter, more adaptable optical systems is undoubtedly exciting, yet not without complexities that require diligent navigation. As Lumotive stands at the cusp of a paradigm shift, its future will depend as much on strategic execution and market acceptance as on the strength of its revolutionary technology.