In a pivotal shift within the semiconductor sector, Intel has taken the bold step of divesting 51% of its stake in Altera, a renowned chipmaker that specializes in programmable logic devices. This transaction, facilitated by the investment firm Silver Lake, represents a marked change in Intel’s operational strategy and signals deeper ambitions in an increasingly competitive industry. The implications of this sale extend far beyond mere financial transactions; they encapsulate a broader narrative of technological evolution and strategic realignment within the realm of semiconductor innovation.

The Background of a Strategic Partnership

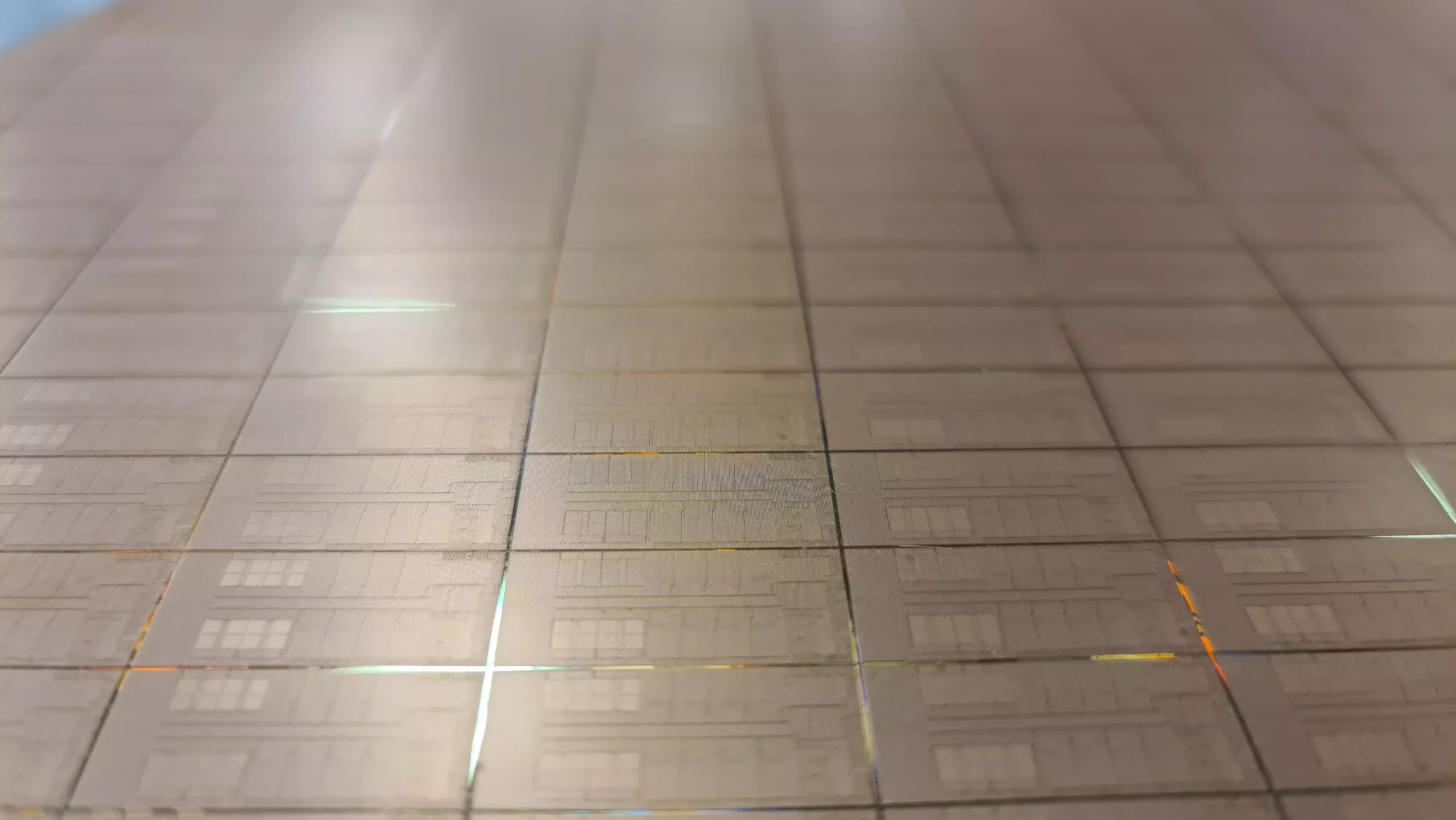

Intel’s relationship with Altera dates back to a time when collaboration between the two entities fostered significant advancements in semiconductor technologies. Before Intel’s acquisition of Altera in 2015 for a staggering $16.7 billion, the duo had established a productive partnership that leveraged their mutual expertise. This acquisition transformed Altera into a division under Intel’s expansive umbrella, primarily focusing on field-programmable gate arrays (FPGAs), which are instrumental in bespoke semiconductor solutions. However, the evolving landscape of technology and customer demands has prompted Intel to reconsider how it manages its assets and aligns its strategic focus.

Valuation Insights and Market Dynamics

The financial terms of this latest deal place Altera’s overall valuation at approximately $8.75 billion. This figure is notably lower than the price Intel initially paid for the company, raising questions about the factors influencing this downward adjustment. Nevertheless, a $4 billion return for half of a company still indicates substantial value. It reflects not only the current market dynamics but also the potential Altera holds in the realm of programmable devices. Intel’s decision to retain a 49% stake ensures it maintains a significant influence over Altera’s strategic direction—a calculated move to safeguard its investment and ensure ongoing collaboration in developing innovative technologies.

Strategic Focus and Future Aspirations

Intel’s official statement regarding the sale emphasizes a pivot towards its core business sectors. This emphasis suggests a desire to streamline operations and concentrate on enhancing its primary semiconductor offerings. By offloading a majority stake in Altera, Intel seems poised to prioritize its foundational chip production while still benefiting from Altera’s innovative capabilities through its minority ownership. This shift symbolizes Intel’s adaptive response to the rapid changes in technology and market requirements, showcasing a higher level of strategic agility.

Silver Lake’s Expanding Portfolio

Silver Lake, a prominent player in technology investment, stands to gain significantly from its stake in Altera. Historically, Silver Lake has demonstrated its commitment to nurturing high-potential tech companies, many of which have emerged as formidable forces in the industry. Recent investments by Silver Lake in firms like Twitter and Airbnb reinforce its position as a major influencer in both tech and digital platforms. The firm has amassed an impressive portfolio valued at over $104 billion, demonstrating its extensive reach and financial clout in the tech landscape.

The Road Ahead for Altera

This split in ownership not only redefines Altera’s operational paradigm but also establishes it as the largest technically independent company in its sector. Although the degree of independence associated with this new status remains uncertain, the potential for innovation and growth appears promising. With the recent appointment of Raghib Hussain, a seasoned executive from Marvell, as CEO of Altera, the company seems well-positioned to navigate this new phase. The leadership shift underscores a commitment to revitalizing its direction and could signify an appetite for broader autonomy in the semiconductor space.

The Broader Implications for the Semiconductor Ecosystem

Intel’s decision to divest a significant portion of its stake in Altera could have profound implications for the semiconductor ecosystem. As companies like Intel streamline their operations, they may create opportunities for other entities to explore partnerships and innovations independently. The future of programmable logic devices hinges on how well Altera can leverage its newfound independence, maintaining relevance in a rapidly evolving industry. The technology firms that embrace flexibility and innovation will undoubtedly emerge as the leaders of tomorrow, positioning themselves to excel in a post-acquisition landscape.