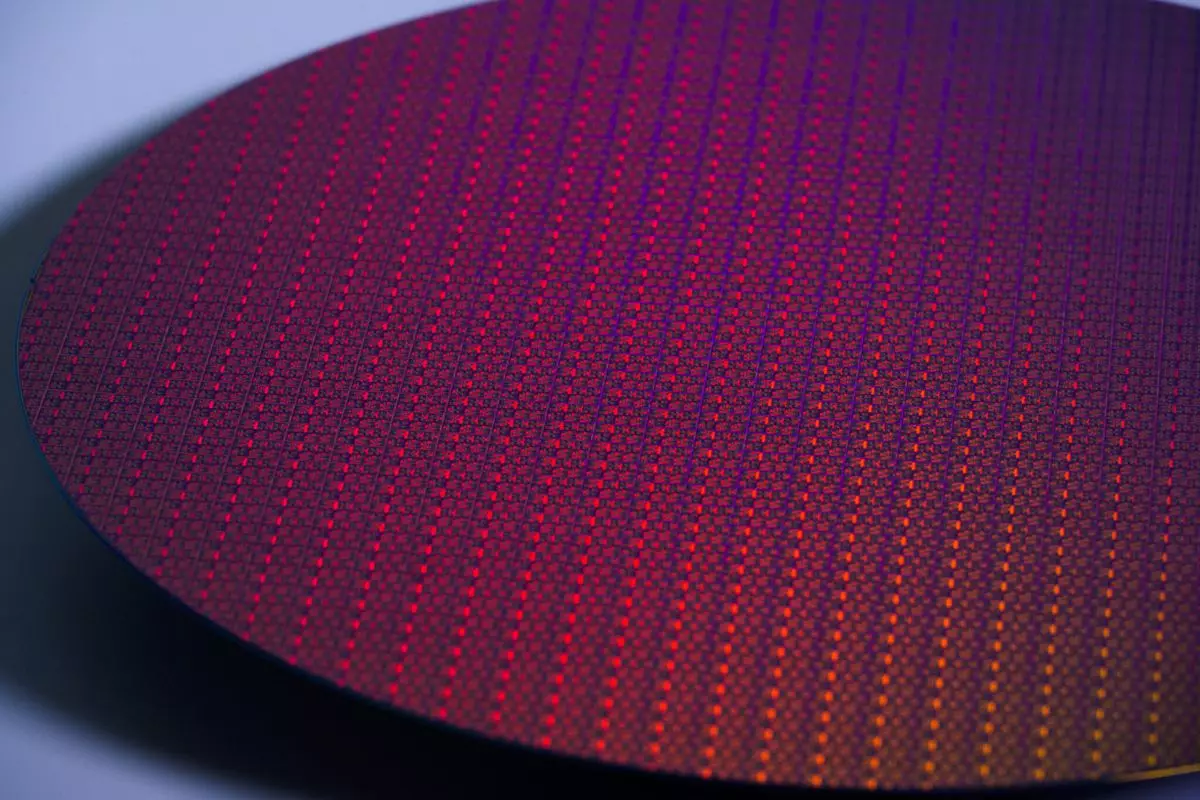

In recent times, Intel’s foundry business remains a focal point of industry conversations, not solely due to its financial trials but also due to the intriguing discussions surrounding its operational strategies. The tension within Intel is palpable, with speculation surrounding the potential separation of its foundry division from the main entities. Vice President John Pitzer’s comments at a recent technology conference illuminate just how nuanced Intel’s current strategy has become. Despite earlier intentions to eliminate reliance on Taiwan Semiconductor Manufacturing Company (TSMC), 30% of Intel’s wafers continue to come from this external supplier.

The company’s inability to completely pivot away from TSMC has drawn attention because it reveals a larger picture of operational strategy amidst ongoing turbulence. “We believe it’s beneficial to keep some of our operations with TSMC,” Pitzer stated, suggesting a pivot from a reductionist strategy to one that embraces competition. This acknowledgment reflects a more pragmatic recognition of the competitive landscape where no singular entity holds all the cards.

The Implications of Outsourcing

Intel’s dependency on TSMC is not merely a logistical issue; it extends into the heart of its competitive stance in the technology market. By outsourcing a significant portion of its wafer production, Intel is potentially sacrificing some margins that would be preserved with in-house manufacturing. While there’s a certain inevitability in modern supply chain interdependencies, Intel must navigate this trade-off carefully. Pitzer pointedly noted, “[We are] not quite sure what the right sort of level is,” suggesting an ongoing evaluation of its dependency on external suppliers.

This strategic ambiguity raises crucial questions: How much reliance on TSMC will Intel allow before it hampers its autonomy? As former CEO Pat Gelsinger sought to reduce this dependency from 30% to 20%, the current leadership remains in a reactive mode amidst unforeseen changes. It’s a delicate balance of maintaining operational capability while fostering internal growth.

Market Dynamics and Future Prospects

Intel is at a crossroads, as outlined by its ongoing leadership transition. With interim CEOs like Dave Zinsner and Michelle Johnston Holthaus navigating these uncertain waters, the future seems less defined than ever. Pitzer’s candidness about Intel’s current position implies that institutional changes within the company may perpetuate the status quo for the time being. As they grapple with market fluctuations, the question remains whether they can implement changes that will transform their dependency trajectory—or if they will become embroiled in a deeper entanglement with companies like TSMC.

Current market dynamics also speak to the necessity for agility in planning and execution. The tech sector is fiercely competitive, with companies adept at leveraging partners to scale operations and drive innovation. Intel’s business model must consider not just the need for autonomy but also the value that strategic partnerships can bring. Tensions have surfaced regarding potential changes in ownership of Intel’s fabs, with firms like Broadcom possibly eyeing this valuable segment of the foundry space. Such rumors add layers of complexity to the narrative, as they could impact both competitive positioning and shareholder sentiment.

The Path Forward: A Review of Strategic Decisions

Looking ahead, the charge towards revitalization in the semiconductor market mandates that Intel takes calculated risks. The earlier ambition of weaning off TSMC presents an idea that may still hold merit, yet the current strategy acknowledges the complexity of modern manufacturing. It is paramount for Intel to adopt a more collaborative playbook rather than solely focusing on insourcing.

Instead of viewing partnerships through a lens of dependency, Intel may benefit from cultivating symbiotic relationships with leading foundries. This could entail embracing co-development projects or revamping financial models that provide flexibility without forfeiting operational effectiveness. The dialog surrounding Intel’s dependency will need to evolve as well, transitioning from a narrative of restriction to one of strategic integration.

Intel stands at this intersection of challenge and opportunity, armed with the potential to redefine its manufacturing ecosystem. The pressing question for the company is whether it can pivot effectively from its traditional mindset to one that embraces innovative partnerships, thus unlocking the potential that is sometimes lost in a game of competitive isolation.