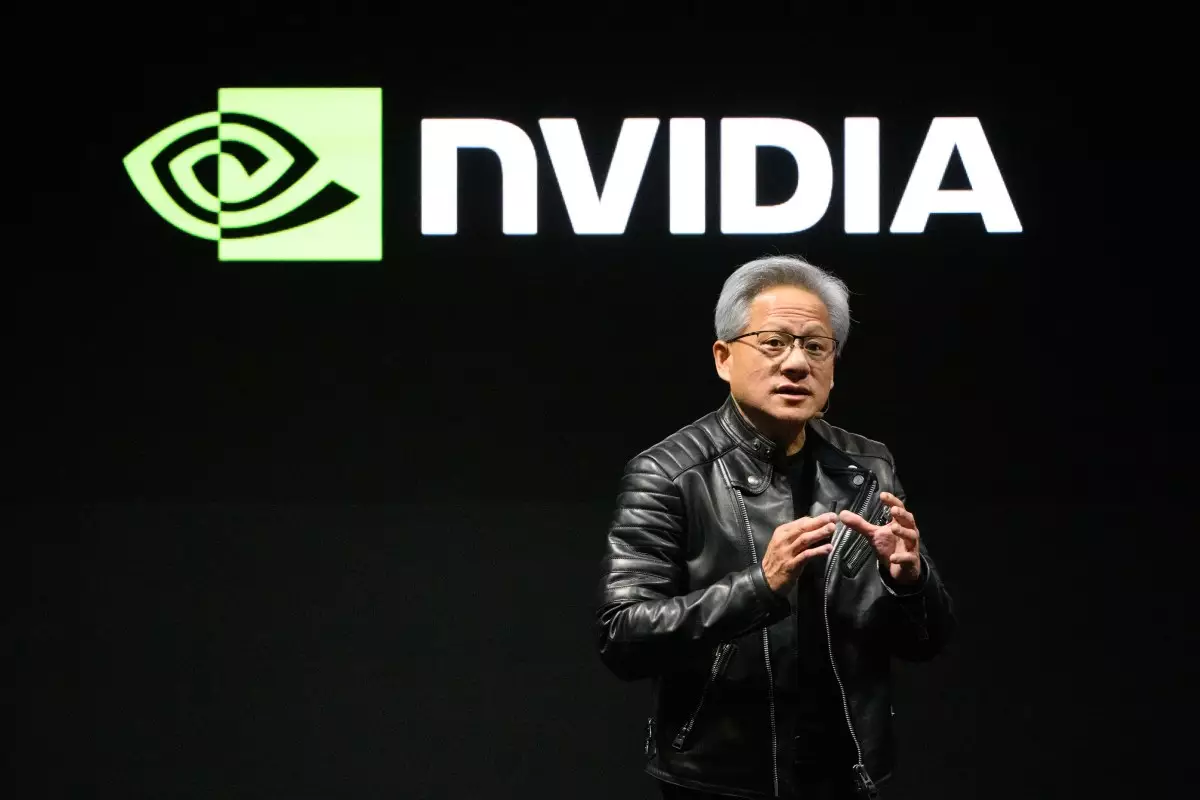

The rise of artificial intelligence (AI) has transformed numerous sectors, but no company has leveraged this revolution more effectively than Nvidia. As the leading manufacturer of high-performance graphics processing units (GPUs), Nvidia has not only captured interest but significantly shaped the trajectory of the AI landscape since the inception of advanced generative AI services, including ChatGPT, initiated a mere two years ago. This article explores the remarkable ascent of Nvidia in the AI domain, examining strategic investments, competitive dynamics, and the broader implications of its financial maneuvers.

Nvidia’s financial performance is telling of its successful pivot towards AI-driven ventures. Since the launch of ChatGPT, Nvidia has witnessed its revenue, profitability, and cash reserves surge dramatically. The company’s stock price skyrocketed by over eight times, markedly reflecting market optimism regarding its influential role in the AI ecosystem. This extraordinary growth trajectory underscores Nvidia’s agility in identifying and capitalizing on emerging trends within the tech industry.

This scramble for AI dominance has prompted Nvidia to significantly bolster its investment portfolio, particularly focusing on AI startups. In 2024, Nvidia ramped up venture capital activities, participating in an astonishing 49 funding rounds for AI companies—a steep increase from the 34 deals made in 2023. This uptick is noteworthy, especially when compared to the combined 38 AI investments made over the four years prior to that, illustrating Nvidia’s intent to secure a competitive edge in the rapidly evolving AI landscape.

Nvidia’s voracious appetite for investment reflects a deliberate strategy to enhance the AI ecosystem by identifying and supporting companies deemed as “game changers.” By weaving a complex network of startups into its operations, Nvidia not only diversifies its influence over the AI domain but also taps into innovative solutions that can complement and elevate its core business.

This strategic focus on startups differentiates Nvidia from other tech giants also involved in the AI funding frenzy. Alphabet and Microsoft have made significant investments, participating in 73 and 40 rounds respectively over the same two-year period. However, Nvidia maintains a lead with a total of 83 deals across 2023 and 2024, emphasizing its proactive approach in shaping the AI future.

Among Nvidia’s most noteworthy investments is a significant stake in OpenAI, the creator of ChatGPT, reflecting a critical alignment with leading AI innovation. Nvidia’s $100 million investment in OpenAI’s massive $6.6 billion round not only underscored its commitment to generative AI but also established Nvidia as a crucial player in the ongoing AI revolution.

Additionally, Nvidia’s participation in the funding for xAI, a venture spearheaded by Elon Musk, represents its willingness to invest in competitive architectures within the AI space. This decision exemplifies that Nvidia is committed to supporting diverse AI endeavors, even those that may conflict with its prior investments.

The overwhelming array of startups that have benefited from Nvidia’s financial backing showcases the chip giant’s versatility. Companies like Wayve, which specializes in autonomous driving technology, and Inflection, a venture founded by DeepMind co-founder Mustafa Suleyman, highlight Nvidia’s keen interest in sectors with monumental potential. Each partnership serves to deepen Nvidia’s reservoir of intellectual property and collaborative opportunities, creating a feedback loop that fosters innovation and enhances its competitive standing.

Despite the visible success of Nvidia’s venture strategy, the firm is not without risks. The fast-paced nature of the AI industry means that today’s promising startup can become obsolete if unable to adapt to rapid changes. Investments in companies like Inflection, which experienced significant operational shifts following acquisition by Microsoft, serve as reminders that strategic investments can yield unpredictable outcomes.

Moreover, as Nvidia positions itself as a central player in the AI ecosystem, it faces potential backlash from competitors and the industry at large. By heavily investing in select startups, Nvidia risks creating perceptions of monopolistic tendencies, which may invite scrutiny from regulatory bodies and industry competitors.

Nevertheless, Nvidia’s aggressive investment strategy seems poised to fortify its leadership in AI innovation for the foreseeable future. By fostering a spider web of partnerships and influencing the direction of nascent technologies, Nvidia not only enhances its own portfolio but actively shapes the broader landscape of AI development.

Nvidia’s meteoric rise within the AI sector is a testament to its proactive investment strategies, driven by its critical role as a leading GPU manufacturer. Its exponential growth, robust investment portfolio, and strategic partnerships underscore a concerted effort to dominate the AI space.

As startups continue to evolve and the AI landscape undergoes relentless transformation, Nvidia’s fortunes are inextricably linked to its ability to remain adaptive and resilient. The company’s future, intertwined with the emergent AI ecosystem, marks a captivating chapter in the evolving narrative of technology, innovation, and competitive dynamics, paving the way for transformative possibilities that lie ahead.