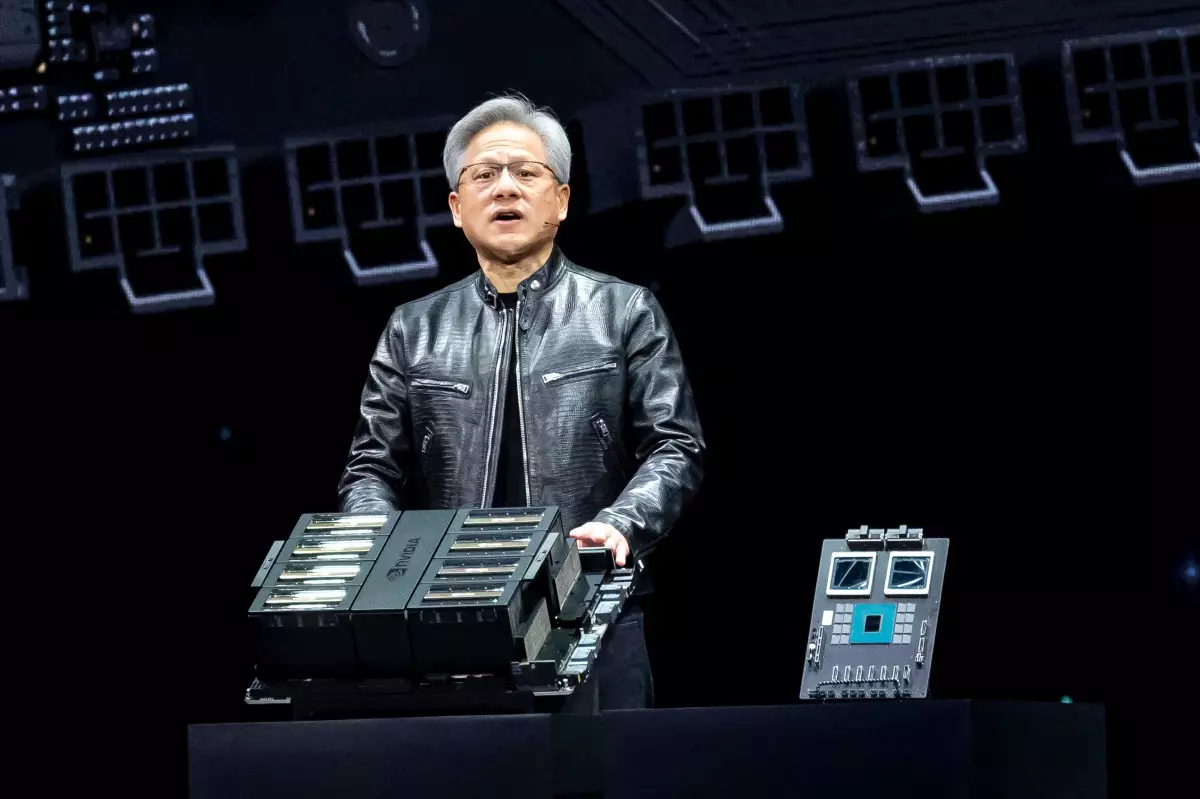

In the ever-evolving landscape of global technology, the interplay between innovation and regulation has become increasingly complex. ByteDance, the parent company of TikTok, has set its sights on acquiring a massive cache of Nvidia chips worth $7 billion by 2025. This ambitious plan raises complex questions in light of U.S. export restrictions which were designed to limit China’s access to advanced technology. Despite these challenges, ByteDance appears poised to circumvent these barriers through strategic planning and operational finesse.

The United States has significantly tightened its grip on the export of advanced AI technology to China. Such restrictions have impacted many tech companies but have particularly affected entities like ByteDance, whose influence and operations extend well beyond its origin in China. By exploiting a loophole, ByteDance aims to sidestep these export limits. Instead of shipping Nvidia chips directly to China, the company is storing its acquisitions in strategically located data centers around Southeast Asia. This intricate strategy allows ByteDance to maintain compliance while still benefiting from cutting-edge technology, demonstrating a keen understanding of regulatory navigation.

Acquiring Nvidia chips is not merely a matter of technological advancement for ByteDance; it’s part of a larger strategy to solidify its infrastructure, enhance its offerings, and dominate the AI market. The company’s Doubao chatbot, which claims an impressive 51 million active users, emphasizes the importance of robust computational power that Nvidia chips deliver. By leveraging such technology, ByteDance not only aims to elevate its existing services but also to innovate further in the AI domain, preparing to compete on a global scale even amidst restrictions.

The ability of companies like ByteDance to effectively navigate U.S. restrictions may set concerning precedents for international trade and technology transfer. Not only does this create a shadow market for advanced chips, but it could also incite further tightening of regulations. Governments may react by re-evaluating export controls, leading to an escalating cycle of tech nationalism. As tech companies adapt to these conditions, we may see a bifurcation of technology ecosystems aligned to national interests rather than global collaborative efforts.

As ByteDance works towards its acquisition goals and nurtures its AI ventures, it is crucial to observe how this will influence its relationships with other tech giants and regulatory bodies. ByteDance’s proactive measures may empower it as a player in global tech, reshaping the dynamics of competition and innovation. The firm’s journey underscores a pivotal message: in the world of technology, adaptability and strategic foresight can determine success, even when faced with complex geopolitical landscapes.

ByteDance’s ambitious plans to acquire Nvidia chips signal not only its growth trajectory but also a defiance of restrictive measures, igniting discussions on the future of technology in a divided global landscape. The company’s ability to securely and innovatively maneuver through regulatory obstacles may set a standard for other tech entities, emphasizing the need for agility in an increasingly regulated world.